Your Right as a Tenant

- June 25, 2025

- Real Estate, Text Blog

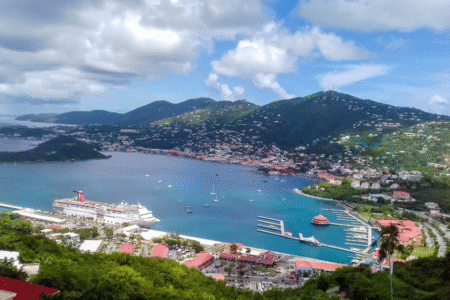

The idea of renting a home in paradise may seem like a dream — but when it comes to life in an island... Read More

Whether to rent or buy a home is a big financial and lifestyle choice, and there’s no right answer — it depends on a variety of factors. Both choices have advantages and disadvantages, and which is better for you depends on your individual circumstances, financial condition and long-term objectives. Here’s a comparison to help you weigh your options:

1. Cost Considerations

Renting

• Low Upfront Payment: To rent, you usually need a security deposit, first month’s rent and — in some places — a broker’s fee. You don’t have to worry about upfront costs such as down payments, closing costs and home maintenance.

• Known Short-Term Expenses: Rent is generally a fixed quantity you are paying each month, which can help with budgeting during the short term. You don’t need to fret over rising property taxes or maintenance costs.

• No Appreciation Benefit: These rent payments never build equity, nor do they provide any financial return.

• Potential for Rent Hikes: Rent can rise over time, particularly if the location becomes more attractive or if market conditions shift.

Buying

• Higher Initial Costs: Purchasing a home often comes with a down payment (often 10-20% of the home’s price), closing costs and continued maintenance fees. These initial costs can be high.

• Accumulating Equity: Each mortgage payment you make gives you more equity (the ownership you have in the property) in the purchase. As property values increase over time, you may also end up with appreciation, which helps increase your net worth.

• Tax Benefits: Homeowners may be eligible for tax deductions, including mortgage interest and property taxes, that can lower overall tax liability.

• Long-Term Stability: With a fixed-rate mortgage, payments remain steady throughout the loan period. Unlike rentals, your rent won’t be increased, and ultimately, you’ll own the property free and clear.

2. Flexibility vs. Stability

Renting

• More Flexibility: With renting, there’s more ability to move. You are usually under a lease, often for a year, and can move relatively easily when the lease expires. Perfect if you expect to change jobs, change lifestyles or would rather live in several places.

• No Commitment: You’re not tied to a property or an area for the long term, so it allows you to explore different neighborhoods, states or even countries.

Buying

• Stability: Owning a home means stability: Stability in housing and stability in lifestyle. Buying a home — if you plan to stay in one location long term — probably makes sense because it roots you in the community and can offer emotional and financial security.

• Less Flexible: When you sell a home, it takes time, and there are costs involved (real estate agent fees, closing costs, etc.) that make it take longer to be able to move quickly. It can be a bigger commitment, especially if market conditions make it hard to sell or rent out the property.

3. Investment Potential

Renting

• Not an Investment: Renting does not build equity because you do not own the property. But you get better returns without the risk of property price volatility.

• Opportunity Cost: Renters can use money that would have been used in a down payment or home maintenance costs to invest in other assets, like stocks which may provide better returns depending on federal, state, and local interest rates.

Buying

• Appreciation: Real estate often gains value in the long term, particularly in prime areas. This can result in a very good return on investment when you sell the home.

• Forced Savings: Monthly mortgage-payments are a form of “forced savings,” creating equity over time. The house becomes yours — free and clear — when the mortgage is paid off.

• Market Risk: Property values might fall in the short term and, in some cases, homeowners can find themselves underwater (owe more on their mortgage than the home’s worth).

4. Maintaining and Responsibility

Renting

• Low Responsibility: Renters are typically not responsible for any maintenance or repairs. If something breaks, the landlord takes care of it, and so renting is simpler in terms of home maintenance.

• No Home Improvement Costs: You’re not responsible for making any major improvements or updates to the property, so you don’t have to worry about shelling out for long-term upgrades.

Buying

• Full Responsibility: Homeowners bear all responsibility for maintenance, repairs and improvements, which can be time-consuming and costly. These are ongoing costs that you’ll have to budget for.

• Control Over Customization: As a homeowner, you can remodel, decorate and add your personal touch to your space as you see fit, while renters generally have limitations in this regard.

5. Lifestyle Considerations

Renting

• Living in Urban Areas: Rented accommodation may be more affordable in more populated cities with high real estate prices Renting lets you enjoy hot, hard-to-afford locations without the pain of expensive home prices.

• Short-Term Living: For those whose lives demand more movement through their work or personal lives, or simply through an itch to see new things, renting provides the flexibility.

Buying

• Pride of Homeownership: Owning a home can provide a sense of pride and accomplishment. You can customize your home and make it fit your style, values and long-term needs.

• Sense of Community: Owning a home tends to encourage a stronger attachment to community as you’re more likely to put time and money into your local area and build longer-term relationships.

Market and Location Factors

Renting

• Soaring Property Values: If you live in an area with fast-rising property prices, renting may be the best way to save cash and avoid paying through the roof for a home. It also allows you to hold out for a possible market correction.

• Lower-Risk Option: Renting is free of the risks that come with up-and-down housing markets. If you’re in an uncertain market, rental can also spare you from getting locked into a mortgage while housing prices sink.

Buying

• Leveraging Low Interest Rates: In markets with low mortgage interest rates, buying can often put you in a better position because you can lock in a low monthly payment for the long haul.

• Potential for Property Value Growth: In fast appreciating markets, getting in now may provide you a larger return on your investment, as property values increase over time.

Things to Consider for Yourself:

• For how long do you intend to remain within the area? If this will be your home for many years to come then buying could be more advantageous because of equity and stability.

• How much money do you have? Do you have the funds available to cover the initial costs of homeownership, such as the down payment, closing costs, and long-term maintenance? If you want more flexibility with your finances, you might be better off renting.

• What are your long-term aspirations? Renting can be ideal if you value flexibility and mobility. But if you want to build wealth over time and invest in your future, purchasing a home can pay financial dividends.

For more info on St. John real estate visit: https://340realestatestjohn.com/

Feel free to call us : 340-643-6068 or email us: [email protected]

Subscribe for our newsletter https://340realestatestjohn.com/incentives/

The idea of renting a home in paradise may seem like a dream — but when it comes to life in an island... Read More

Picture waking to the sound of waves, spending your afternoons snorkeling coral reefs and hiking through the National Park and, come sundown,... Read More

If you’ve ever fantasized about living in a tropical paradise, St. John in the United States Virgin Islands might just be whispering your... Read More

Log in

Please enter your username or email address. You will receive a link to create a new password via email.

Join The Discussion