Your Right as a Tenant

- June 25, 2025

- Real Estate, Text Blog

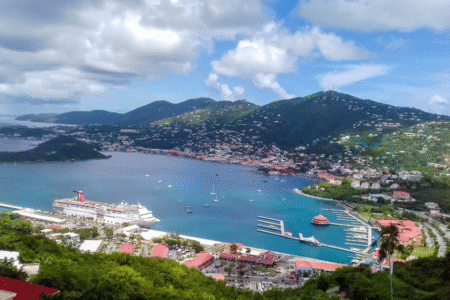

The idea of renting a home in paradise may seem like a dream — but when it comes to life in an island... Read More

Qualifying for a home loan in St. John, U.S. Virgin Islands, is similar to applying for a mortgage in the mainland U.S., but there are some special considerations since the island has a unique real estate market. Here’s a rundown of the process to help you out:

Credit Score Requirements

• Typical Credit Score: To qualify for a conventional mortgage, you typically need a credit score above 620, although higher scores (above 700) will help you access better rates and loan terms.

• Getting a Better Credit Score: If your credit score is on the low side you might want to take some steps to correct it before you fill out the application process by paying off your debts, not applying for new credit cards, and paying off any existing loans on time!

Down Payment Requirements

• Conventional Loans: A conventional loan typically requires a 20% down payment based on the purchase price. Alternatively, there are loan programs available with lower down payments, around 5-10%, but often do require private mortgage insurance (PMI).

• FHA Loans: If you are eligible for an FHA loan, you can put down only 3.5%. This may be the best choice for borrowers with lower credit scores and/or limited savings.

• Jumbo loans: For borrowers seeking homes above certain price limits, jumbo loans will be needed, typically requiring larger down payments (20 to 30 percent) and higher credit scores. Many St. John properties, particularly waterfront or luxury homes, are likely to be considered jumbo loans because of their higher prices.

Proof of Income and Debt-to-Income Ratio (DTI)

• Income Verification: Lenders will need to verify your income to make sure you can afford the monthly mortgage payments. You will have to submit pay stubs, tax returns and bank statements for the previous two years.

• Debt-to-Income Ratio: The DTI ratio of most lenders is below 43%, which means your monthly debt payments (including your new mortgage payment) should be not more than 43% of your gross monthly income. A lower DTI ratio can increase your loan approval chances and yield better terms.

Virgin Islands-Specific Loan Programs

• Local Banks and Lenders: Some local bank and lenders in the U.S. Virgin Islands offer mortgage loans specifically for the local market, including Banco Popular and FirstBank. These institutions understand the distinctive challenges and regulations associated with purchasing property in the Virgin Islands.

• USDA Loans: If the property is located in an eligible area and your financial profile meets USDA standards, you might be able to qualify for a USDA loan with a 0% down payment. Some parts of St. John may qualify for these loans.

Appraising and Inspecting the Property

• Appraisal Guidelines: Appraisers work as independent contractors and are required by lenders to validate the property’s price to the loan amount. The island’s real estate market can be tricky, and some properties are more difficult to appraise because of their island location, such as hillside views or ocean views.

• Income Property: A detailed income property inspection is suggested to identify any potential issues with the property (i.e. structural issues, water damage, or deferred maintenance). That is especially important in the Virgin Islands, where tropical weather can take a toll on the lifespan of homes.

Mortgage Pre-Approval

• Why Pre-Approval Matters: A pre-approval letter from a lender will give you a snapshot of how much you can pay, and prove to sellers that you’re a serious buyers. It can be particularly useful in a competitive market like St. John.

• Required Documents: To get pre-approved, you will need to submit:

Proof of income (pay stubs, tax returns, and bank statements)

Proof of employment

Credit report

List of debts and assets

Down payment amount

Interest Rates and Terms

• Costs on Each Island: Interest rates for St John mortgages are usually similar to rates offered on the mainland; however, since a smaller market with fewer lenders and higher perceived risk, St John rates may be a bit higher.

• Fixed vs. Adjustable-Rate Mortgages (ARMs): You’ll have to choose between a fixed-rate mortgage (where your monthly payments are stable) and an ARM, whose rates can change after an introductory period. You may also find ARMs more common for vacation or investment properties.

Property Taxes and Insurance

• Property Taxes: Property taxes are typically less than in the mainland U.S. But it’s essential to carve out space for them in your ongoing spending.

• Hurricane and Flood Insurance: Owners of homes in the Virgin Islands are required to get hurricane and flood insurance, which can also raise the total cost of ownership. Before a loan is approved, lenders need a proof of insurance.

Additional Costs

• Closing Costs: Closing costs in St. John normally go between 2-5% of the loan quantity. That includes lender fees, title insurance, attorney fees and recording fees. Then, budget for these extra costs.

• Other Requirements for Foreign Nationals: If you are not a US citizen, you may also need to fulfil further requirements in order to qualify for a loan. Non-residents can still buy property, but will likely need a larger down payment (30-40%) or face different lending conditions.

Using the Property as a Holiday Home or The Rental

• Vacation Home Financing: If you plan to use the property as a second home or vacation rental, lenders may expect larger down payments (20-30%) and tighter loan terms than they would for primary residence loans. The property must also meet occupancy requirements for second-home financing.

• Potential Help from Rental Income: Certain lenders let you add potential rental income to your loan qualification, which can enable you to purchase a higher-priced property.

{Call us to get more information on mortgages}

• Localized Knowledge: An agent and mortgage broker who are acquainted with St. John’s market will guide you through the loan qualification and process more easily. And they can link you with lenders familiar with the island’s unique challenges and opportunities, which can increase your chances of getting financing.

Do you want assistance with locating local lenders or looking at pre-approval options?

For more info on St. John real estate visit: https://340realestatestjohn.com/

Feel free to call us : 340-643-6068 or email us: [email protected]

Subscribe for our newsletter https://340realestatestjohn.com/incentives/

The idea of renting a home in paradise may seem like a dream — but when it comes to life in an island... Read More

Picture waking to the sound of waves, spending your afternoons snorkeling coral reefs and hiking through the National Park and, come sundown,... Read More

If you’ve ever fantasized about living in a tropical paradise, St. John in the United States Virgin Islands might just be whispering your... Read More

Log in

Please enter your username or email address. You will receive a link to create a new password via email.

Join The Discussion