Your Right as a Tenant

- June 25, 2025

- Real Estate, Text Blog

The idea of renting a home in paradise may seem like a dream — but when it comes to life in an island... Read More

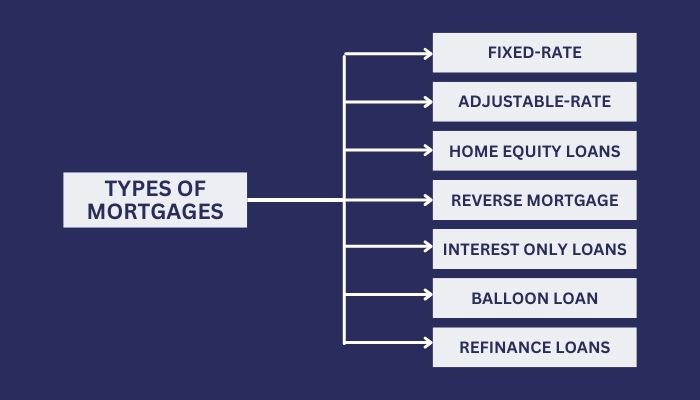

There are several types of mortgages that you can use to buy a house in St. John, U.S. Virgin Islands. Each comes with various terms, benefits, and requirements. Therefore, here are some of the mortgages that you will encounter when purchasing a home:

1. Fixed-rate mortgage

Description: The interest rate does not change for the entire duration of the loan, allowing you to know what to pay monthly.

Terms: The mortgage can be for 15 or 30 years.

Benefits: You have stability in paying, making budgeting easy.

Considerations: Normally incurs a high-interest rate compared to adjustable-rate mortgages since it remains constant.

2. Adjustable-rate mortgage

Description: Most have an interest rate that an adjust following the performance of a particular index, reflecting the cost that your credit would have been for the lender.

Terms: Generally, the interest rate is constant for 5, 7, or 10 years like a 5/1 ARM, and it starts to increase annually.

Benefits: Offers a less initial interest compared to the fixed-rate mortgage.

Considerations: Payments could significantly rise once the fixed period ends as interest rates rise, exposing you to potential financial risk.

3. Interest-only mortgage

Description: You pay the interest for the loan for a set period, generally 5 to 10 years, then start paying the principal.

Terms: Following the interest-only period, you must pay both principal and interest, which might be high.

Benefits: You make low payments during the interest-only period.

Considerations: Payments significantly rise once you start paying the principal; you don’t build equity during the interest-only period.

4. Jumbo Mortgage

Description: Jumbo mortgage is more extended than the conforming loan limits set by Fannie Mae and Freddie Mac. In the U.S. Virgin Islands, it is general for those limits to be higher than on the mainland. This type of mortgage may be available as both fixed-rate and adjustable-rate mortgages.

Benefits: It allows buying high-value properties, which will require high-value loans.

Considerations: Possibly higher rates, a much larger down payment, and strict credit requirements.

5. FHA Loan

Description: FHA loan is insured by the Federal Housing Administration and may be beneficial for first-time home buyers or those with imperfect credit.

Terms: Typically offered as fixed-rate loans, with terms of fifteen or thirty years.

Benefits: Include lower down payment requirements 3.5% and lower minimum credit score compare to other loans.

Considerations: Mortgage insurance premiums increase more payable money. 6. VA loan

6. VA Loan

Description: The VA loan is guaranteed by the U.S. Department of Veterans Affairs and is available to military veterans, active service members, and their families.

Terms: Typically available with fifteen or thirty-year terms as a fixed-rate mortgage.

Benefits: Include an inability to fund the required down payment which means better interest rates and lack of insurance

Considerations: This is not always obtainable for all individuals even with a high credit score

7. USDA loan

Description: USDA loan is backed by the U.S Department of Agriculture and is intended for buyers within eligible rural and suburban areas.

Terms: Available as a long-term fixed-rate loan.

Benefits: It has no down payment and an attractive interest rate.

Considerations: It is nevertheless limited to the eligible rural areas, and income limits apply

8. Balloon mortgage

Description: A balloon mortgage is a short-term loan that allows you to make a few small payments within the set time frame, followed by the balloon payment to wipe out the rest of the sum after the last term.

9. Home equity loan

Description: A home equity loan is a kind of loan used for large expenses or refurnishing. It is possible to take a large sum of money and repay it over a long term.

Terms: The interest rate on a home equity loan is fixed.

Benefits: This kind of loan is a good option for major house maintenance.

Considerations: This kind of borrowing has the risk to lose the mortgaged property if you cannot pay the debt back. One must consider before taking that loan: When and if they will be able to make all the payments. Take into account that in case you fail to pay the debt off, you will lose your property.

10. Reverse mortgage

Description: It is a mortgage for 62-year-old borrowers and older. This type of mortgage allows to turn some of the house’s cost into cash.

Terms: The loan should be paid back when the home is acquired or when the home owners permanently move out or die.

Benefits: The benefit of the reverse mortgage is extra income. But it should be mentioned that the loan can become noticeably larger.

When choosing a mortgage type, one should take into account their financial condition, plans, and the period they are going to spend living in this property. It is recommended to consult a broker or financial advisor. They can help in choosing the best mortgage plan based on the various aspects of one’s life and financial situation. For any query on mortgages feel free to contact 340realestate, your partner in real estate journey in St. John

Email : [email protected]

Call : 340-643-6068

The idea of renting a home in paradise may seem like a dream — but when it comes to life in an island... Read More

Picture waking to the sound of waves, spending your afternoons snorkeling coral reefs and hiking through the National Park and, come sundown,... Read More

If you’ve ever fantasized about living in a tropical paradise, St. John in the United States Virgin Islands might just be whispering your... Read More

Log in

Please enter your username or email address. You will receive a link to create a new password via email.

Join The Discussion