Your Right as a Tenant

- June 25, 2025

- Real Estate, Text Blog

The idea of renting a home in paradise may seem like a dream — but when it comes to life in an island... Read More

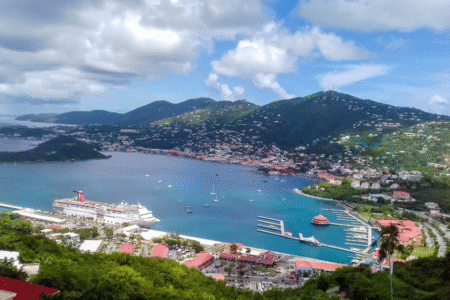

Buying your first home in St. John, U.S. Virgin Islands, can be a challenging but rewarding experience. The steps you need to take are as follows:

Understanding the Market

Property Type: While St. John offers various property options in the single-family, condo, villa, and land segments, the most desirable areas in the current market include Cruz Bay, Coral Bay, and anything in or close to the Virgin Islands National Park.

Market Conditions: St. John has a strong real estate market, which means that you must acquire an understanding of average prices and local trends before setting your sights on a particular price segment.

Financing your purchase

Mortgage Options: A U.S.-based mortgage provider will have few issues with lending you money to buy a property in the U.S. Virgin Islands. However, you may have to adhere to slightly different terms. You could also approach local lenders that offer some form of mortgage financing, but you should remember that most American banks will not work with you because they are not licensed in the Virgin Islands.

Down Payment: A down payment of 20% or more is typical, though some lenders might require more depending on your financial situation and the property type.

Interest Rates: Interest rates in the U.S. Virgin Islands might be slightly higher than on the mainland due to the higher risk associated with the location. Interest rates also vary if it is a second home purchase that will be a rental versus a residence.

Working With a Real Estate Agent

Finding a Local Agent: Finding a Good Real Estate Agent (Consider 340 Real Estate Company for all your property needs in St. John) is significant while purchasing a property in St. John. A real estate agent in St. John, U.S. Virgin Islands, generally pays the seller.

Agent Fee: Typically, the seller pays the agent’s commission, but confirming this upfront is always good.

Choosing The Right Property

Location: Proximity to beaches, views, access to Cruz Bay or Coral Bay, etc., are important factors to consider in terms of property value. What is important to you: privacy, convenience, or investment opportunity?

Utilities: Some areas may have restricted access to public water, electricity, internet, etc. Many homes use cisterns for water and solar panels for energy.

Property condition: Tropical climate calls for making sure construction materials and the property, in general, are durable and hurricane-proof.

Legal considerations

Title Search: Is there a clean title on the house and the land? A thorough title search might be necessary due to any claims or liens on the property.

Property Tax: In general, property taxes are lower in the USVI than in many U.S. mainland states. Keep in mind that they are still based on property value and type.

Zoning Laws: Always check local laws and regulations – especially if you are planning to build on a lot or make extensive modifications to an unfold property.

Making an Offer

Negotiation: Be prepared to negotiate, and make sure your offer is based on recent comparable sales, the house condition, and market demand.

Offer Letter: Your written offer should consist of the price you’d like to offer, terms of sale, all contingencies, and a closing date.

Inspection and appraisal

Home inspection: Book a local home Inspector to assess the house’s health. Pay special attention to structural quality, roofing, and signs of water or pest damage.

Appreciation: A lender will always require an appraisal to make sure they are lending the value of the house you wish to buy.

Closing process

Closing costs: Closing costs range between 3% and 5% of the house value. This will include loan origination fees, title insurance, legal fees, and recording fees.

Closing Attorney: We recommend having a local attorney assist with the closing to make sure all laws and regulations are handled properly.

Post-Purchase Considerations

Insurance: Buy homeowner insurance that covers hurricanes and other natural disasters of the area.

Property Management: If you are buying a vacation home or rental property, think about hiring local help for maintenance repairs of course rental reviews, and the like.

Ongoing Costs: Take into consideration ongoing expenses can include property taxes, utilities, and maintenance (as well as any homeowners’ association / HOA fees if applicable)

Living in St. John

Community Involvement: Meet your neighbors, and become a member of the city. Click on these icons to go directly to the St. John’s Facebook site. The Events listing gives you a flavor of what is going on in our church community.

Lifestyle Adjustments: Life in St. John moves a little more slowly than on the mainland. You have to go island mode and lower your expectations.

Spending a little bit of your time on research and preparation when you buy a home in St John can make the buying process as smooth an experience. The best approach of course, is to visit the island several times and frequent different neighborhoods so you can get a real sense of what it would be like living there. For any query related to St. John real estate, feel free to call : 340-643-6068 or email us : [email protected]

For more information you can also visit our website : https://340realestatestjohn.com/

The idea of renting a home in paradise may seem like a dream — but when it comes to life in an island... Read More

Picture waking to the sound of waves, spending your afternoons snorkeling coral reefs and hiking through the National Park and, come sundown,... Read More

If you’ve ever fantasized about living in a tropical paradise, St. John in the United States Virgin Islands might just be whispering your... Read More

Log in

Please enter your username or email address. You will receive a link to create a new password via email.

Join The Discussion